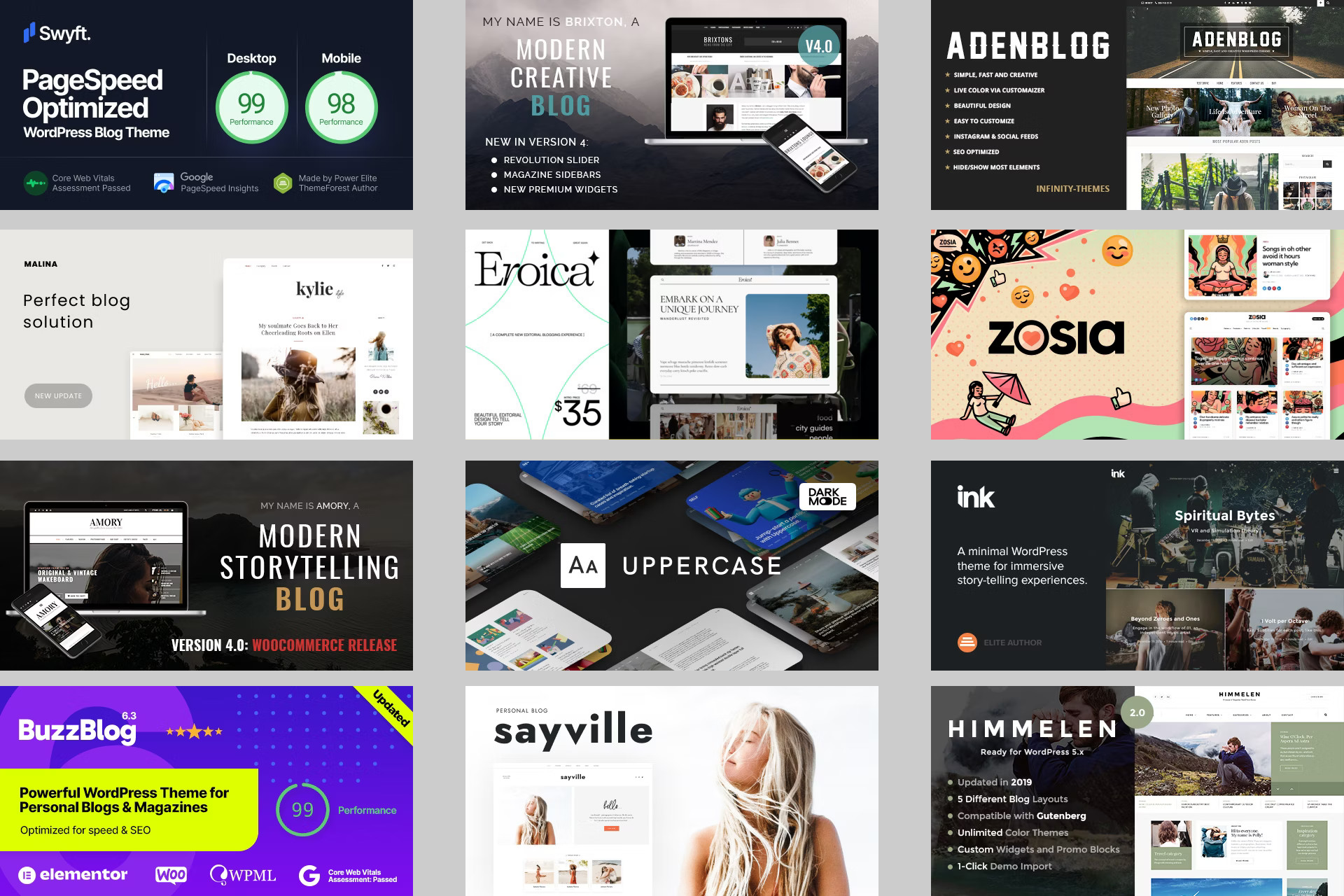

In the world of WordPress blogging, finding the perfect theme for your website is essential for creating a captivating online presence. With a myriad of options available, from minimalist designs to feature-rich templates, the quest for the best WordPress blog theme can feel overwhelming. However, fear not! In this guide, we'll explore the essential steps to help you navigate this process and discover the theme that perfectly complements your blogging objectives and resonates with your audience.

Welcome to the digital era, where your business's first impression is often made through your website. However, in the vast landscape of the internet, a stunning website is not enough. It needs to be secure. GatsbyJS, a cutting-edge web framework, opens the doors for businesses to create visually striking websites, but the focus must extend beyond aesthetics—security is paramount.

In the fast-paced digital landscape, businesses are continually seeking ways to enhance their online presence, drive lead generation, and optimize their websites for search engines. One powerful solution that has gained prominence is leveraging Gatsby, a modern web framework that combines the speed of static sites with the flexibility of dynamic web apps. In this blog post, we'll explore how businesses can harness the potential of Gatsby to create websites that not only captivate visitors but also excel in lead generation and SEO campaigns.

To ensure your business not only survives but thrives during these periods, strategic website adjustments become paramount. In this article shared by Squarespace Plugins, we'll delve into essential website modifications that will empower your business to not only endure but excel in trying times.